But this is now in the past; so where do we go from here?

I've been in the camp that a bear market has been underway since Jan 1, 2015. The internals of the market have been deteriorating and the transports are leading the DJIA south. I don't see a marvelous recovery happening in the Transportation sector and once the DJIA breaks 16000 again we will have confirmation of a bear market from the Dow Theory. Over the past year; we have had Dow Theory NON confirmation of a bull market. I expect once this breaks we are going to see acceleration to the downside. However; trading short in bear markets is difficult because you have to be on high alert for the vicious bear market rallies. I'm not a big stats guy; but I've seen and would be willing to bet that the biggest 1 to 2 day rallies in the market occur during bear markets.

The bull market is over. The monthly ADX has kicked up suggesting a trend has begun; which is not up if you were curious. The RSI on the monthly of the SPX has breached the 50 level and we will now focus on using trending indicators. Ok; so we have the long term view out of the way; bearish.

In the interim; the selling still isn't over just yet and traders will remain on high alert as they search for the lows. I personally believe that the short term lows that will give us the bull rally will come a day or two after we breach the September lows in the indicies.

An interesting chart I've been following is the relative performance of Transports vs DJIA for the reasons described above. When this bear rally does come; I'm thinking the greatest squeeze may appear in the Transports before we roll back over.

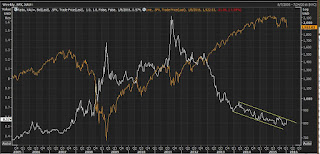

So many facets of the stock market are on the cusp of major trend changes. Anyone who has followed me over the years know my long term theories on gold and I haven't written much about it as of late because there haven't been any macro changes to my views. The only change has been price. Let's just observe a few charts to go with the current theme of this post; major trend change at hand? As you'll see in the below chart; anytime the gold to SPX has blown out one way or the other; it has been a good confirmation of stock market direction. Once again; we are at a critical turning point in the ratio and the market is on the brink of disaster. Failure for the ratio to reach the bottom of its channel was an indication of strength (or future equity weakness). When QE3 was launched in September of 2012; something changed.

Food for thought: Vix relative to Spx has been a good precursor to large drops in the equities.

Conclusion: The bear market is here; new highs would need to be made for longer term views to change.