Fake out below the 30Week Moving average; when I was watching this live; I tweeted that 1285 was the swing pivot on the day gold rose 50$ (3%). That swing pivot was also the 30 week. (wink wink).

Monitoring Gold to Silver ratio; if this ratio begins a steady new downward trend; then, game on.

Based on where the monthly indicators are on gold/silver mining stocks; I think this ratio will trend lower and silver will take the lead.

The green light to buy the dip is at hand; with a caution warning until 1400 is crossed.

Reminder from May 4th.

Reminder from March 3rd

Thursday, June 26, 2014

Wednesday, June 25, 2014

@Mattdubz86

I post a lot of charts/ideas/rants on Twitter that are worthy of checking out. Most of the content I bring to the table doesn't end up on this blog. Would never recommend Twitter stock, but the means of communicating data and information is amazing. Check me on there.

And continue to BTD in the miners!

And continue to BTD in the miners!

Saturday, June 21, 2014

Miner Update (Pun intended)

My continued belief is that a sustainable new bull market in the miners without the crazy swings won't come until gold is steadily over 1400. With that in mind; lets have a look at the charts after a stellar few weeks in June.

Reminder from May 4th.

Reminder from March 3rd

The long view:

Reminder from May 4th.

Reminder from March 3rd

The long view:

Looking to add; the gap up on Thursday adds an intriguing area to watch. Could be a breakaway gap; in the event this gap isn't filled early next week; ideally by end of day Monday. Then i'll be looking to add. I'm leaning more towards a breakaway gap just because of the larger picture positioning. But the market is always in the mood to mind **** you. So pay attention.

Saturday, June 14, 2014

200SMA Halts Miner Rally

Time for a pause in the rally, or a ripper through 200SMA. A scan through a select group of names I follow across gold/silver miners large, medium or small cap. For the most part, they are all seeing a pause at/below/above 200SMA. Use the volatility in this sector to your advantage, they fall out of love very fast when momentum halts, BTFD.

Technically speaking...We closed OVER the 200SMA....

60 min GDX view

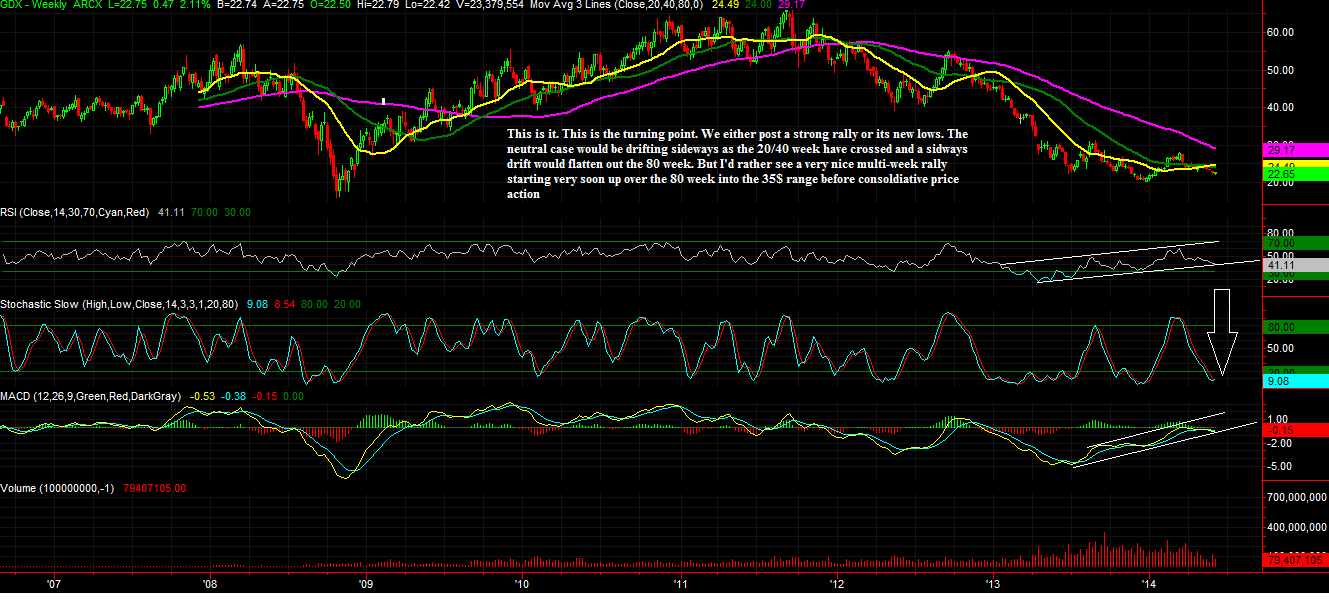

Weekly technical positioning

Bonus Charts: IAG

Thursday, June 12, 2014

Miners

Don't forget about these guys.

All technical lenses are looking gorgeous. (Daily/Weekly/Monthly)

I had to leave my recent platform, so the charts will look a bit different going forward.

Let's just talk levels for a minute here, I wrote about 23.07 on GDX being a major tipping point and I thought we'd go straight down to December lows if that broke. Well when it broke, we dipped to 21.93. So any orders to to go short made a quick dollar when that broke. We are back over 23.07 and technically speaking, things are looking quite nice.

Baring another smash down in the metals themselves, we are a GO to buy the dips.

Other indicators I use from time to time are also giving buy signals; so hold on to your pants here and stay alert and don't forget about the miners. "Use the volatility, don't let the volatility use you", A quote from Rick Rule that I've taken very seriously in this sector during this past year+.

Thursday, June 5, 2014

In Like Flynn

Daily Lens

Bullish:

- Back in the channel.

- MACD in boss mode.

- RSI >50 sloping upwards.

Bearish:

- Declining volume

- Nose bleed Stokes

- 50 crossed 100.

When the head and shoulders top didn't pan out, it's been a strong rally higher. A failed technical pattern is probably one of the stronger momentum trades/signals I've noted.

NFP tomorrow and no POMO.

Reminder of macro indicators rolling over:

- NYSE new highs not confirming market new highs.

- Margin debt 2 month consecutive readings lower.

- 30 year yields vs SPX divergence

- USDJPY (carry trade) monthly MACD has crossed, the trend is weakening.

http://www.financialsense.com/contributors/cris-sheridan/tracking-peak-corporate-profits

BONUS CHART: GDX

Wednesday, June 4, 2014

Quick Recap

I don't see much available upside room on the daily bars coming into Draghi and NFP. There will be no QE out of Draghi tomorrow coupled with a 2.5BLN POMO. That leaves us NFP which won't really matter either way unless its a huge miss or huge beat; there is no POMO scheduled for NFP Friday; again. Interesting. Makes me think that NFP will be in-line/beat as the FED must know what the data is ahead of time when making the POMO schedule.

IWM-short

QQQ- neutral/ready to get short

GC- No idea what this thing is going to do short term; technical indicators are at extreme low levels on daily and weekly; so any big dip from here should most certainly be bought.

6/4/14:

6/3/14:

^

^

IWM-short

QQQ- neutral/ready to get short

GC- No idea what this thing is going to do short term; technical indicators are at extreme low levels on daily and weekly; so any big dip from here should most certainly be bought.

| Thu, Jun 5, 2014 | Fri, Jun 6, 2014 | Outright Treasury Coupon Purchases | 08/15/2021 - 05/15/2024 | $2.25 - $2.75 billion |

| Mon, Jun 9, 2014 | Tue, Jun 10, 2014 | Outright Treasury Coupon Purchases | 02/15/2036 - 05/15/2044 | $0.85 - $1.10 billion |

6/4/14:

6/3/14:

^

^Monday, June 2, 2014

Monitoring Developments (Steady Eddy not so Steady)

Losing the 30 week SMA after 16 weeks is impressive for the bears.

The short term path of least resistance is down.

Euphoria in the stock market.

Action packed week here ( Data dump and ECB meeting)

The short term path of least resistance is down.

Euphoria in the stock market.

Action packed week here ( Data dump and ECB meeting)

- ADP Weds

- Super Mario Draghi gets on the mic Thursday

- Non Farm Payroll Friday

Subscribe to:

Posts (Atom)

.png)

.png)