3/11/19:

Model reversal signal on the H4 inside the swing short entry. If you want to be short this market you have to allow this current up cycle to exhaust itself. Daily ATR is around 20ish pts. Given the model direction; I'd expect 1 full ATR up from here in this cycle to burn off the H4 reversal warning.

2748 as of last trade.

The Mind of a Trader

'Forecasting the fundamental story through charts'

Sunday, March 10, 2019

Sunday, January 10, 2016

Where do we go from here?

I had been very bearish the market as we closed out 2015; for a plethora of reasons. But for the simple view; see my below tweet.

But this is now in the past; so where do we go from here?

I've been in the camp that a bear market has been underway since Jan 1, 2015. The internals of the market have been deteriorating and the transports are leading the DJIA south. I don't see a marvelous recovery happening in the Transportation sector and once the DJIA breaks 16000 again we will have confirmation of a bear market from the Dow Theory. Over the past year; we have had Dow Theory NON confirmation of a bull market. I expect once this breaks we are going to see acceleration to the downside. However; trading short in bear markets is difficult because you have to be on high alert for the vicious bear market rallies. I'm not a big stats guy; but I've seen and would be willing to bet that the biggest 1 to 2 day rallies in the market occur during bear markets.

The bull market is over. The monthly ADX has kicked up suggesting a trend has begun; which is not up if you were curious. The RSI on the monthly of the SPX has breached the 50 level and we will now focus on using trending indicators. Ok; so we have the long term view out of the way; bearish.

In the interim; the selling still isn't over just yet and traders will remain on high alert as they search for the lows. I personally believe that the short term lows that will give us the bull rally will come a day or two after we breach the September lows in the indicies.

An interesting chart I've been following is the relative performance of Transports vs DJIA for the reasons described above. When this bear rally does come; I'm thinking the greatest squeeze may appear in the Transports before we roll back over.

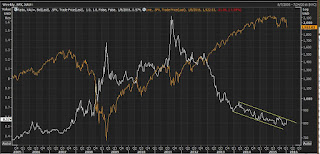

So many facets of the stock market are on the cusp of major trend changes. Anyone who has followed me over the years know my long term theories on gold and I haven't written much about it as of late because there haven't been any macro changes to my views. The only change has been price. Let's just observe a few charts to go with the current theme of this post; major trend change at hand? As you'll see in the below chart; anytime the gold to SPX has blown out one way or the other; it has been a good confirmation of stock market direction. Once again; we are at a critical turning point in the ratio and the market is on the brink of disaster. Failure for the ratio to reach the bottom of its channel was an indication of strength (or future equity weakness). When QE3 was launched in September of 2012; something changed.

Food for thought: Vix relative to Spx has been a good precursor to large drops in the equities.

Conclusion: The bear market is here; new highs would need to be made for longer term views to change.

Wednesday, September 9, 2015

The market lulled everyone to bed

And then it woke up while they were sleeping.

Shanghai Composite: Saved by the weekly Ichi but lots of bearish messages from the Ichimoku here.

My views on the SPX:

The market is excellent at shaking out traders during a wedge. Below are two views of the SPX hourly through this decline from the choppy toppy action. Lower one includes indicators.

And the long term weekly view. Doesn't look pretty with the Ichi cloud being broken.

Stay alert out there.

Matt

Shanghai Composite: Saved by the weekly Ichi but lots of bearish messages from the Ichimoku here.

Nikkei: Saved by the weekly Ichi but lots of bearish messages from the Ichimoku here.

My views on the SPX:

The writing has been on the wall for the past 12-18 months to stay away from US Domestic equity markets. High Yield , for one was screaming at whoever was willing to listen, now that we have caught down to HYG , all eyes on the FOMC . Now, the first SPX to HYG chart shows the hourly view over the YTD. I use this view because the correlation on the Daily view back to 2008 still has a correlation of .8 which is very strong, so then we can narrow the view and look at the hourly frame for more clues to direction of the market in shorter time frames.

There is more pain to come, it will pay to remain on sidelines or stay short. As we enter the crash prone season of the stock markets. I’ll be looking to cover shorts and nibble long as we end October and make the year end push.

The market is excellent at shaking out traders during a wedge. Below are two views of the SPX hourly through this decline from the choppy toppy action. Lower one includes indicators.

And then there is the SPX update I had sent around on Monday. The 1950 stops were clearly ran. However with the late day push by the bears we regained 1950 and pushed the air pocket down to 1940. As I'm writing, futures gapped down and are breaking down out of the wedge. My downside targets are noted on the charts in the 1770-1800 range. That will be an area to watch to nibble long/cover shorts.

And the long term weekly view. Doesn't look pretty with the Ichi cloud being broken.

Stay alert out there.

Matt

Thursday, June 25, 2015

It's been a while

The USA is the "wealthiest" country right? If we are going to remain an empire, we are going to have to convert fast enough to renewable energy before the rest of the world. Solar, wind, water, nuclear are going to be the drivers. There is enormous amounts of money pouring into all of these sectors. I'll be including this topic in my posts going forward. For now, let's touch base on a few things.

First,

Apologies for the delay in writing. I'm pursuing the Chartered Market Technician exam, which explains a small portion of my absence in continuing this shared journal of my thoughts on the market. Aside from the CMT, I've been trying to wrap my head around what I can and can't share via my views of the market from compliance at work. It's unreal how much compliance and regulation that is coming to trading desks globally.

My views are my views and my views only. Period.

Alright, lets get started.

Below is a series of charts I am watching and will be discussing as they play out.

For this post; here are the charts, and I will elaborate individually as we progress.

XAU/XAG vs SPX

China....Love it.

Smart index vs. NYA vs. Bloomberg comfort index: dates on chart.

First,

Apologies for the delay in writing. I'm pursuing the Chartered Market Technician exam, which explains a small portion of my absence in continuing this shared journal of my thoughts on the market. Aside from the CMT, I've been trying to wrap my head around what I can and can't share via my views of the market from compliance at work. It's unreal how much compliance and regulation that is coming to trading desks globally.

My views are my views and my views only. Period.

Alright, lets get started.

Below is a series of charts I am watching and will be discussing as they play out.

For this post; here are the charts, and I will elaborate individually as we progress.

XAU/XAG vs SPX

My thoughts on 10 year yields: Going no where, but everywhere.

My thoughts on near term spoos: expiry over this chart is over 2120.

Golds vs Inverse Nikkei

China....Love it.

Smart index vs. NYA vs. Bloomberg comfort index: dates on chart.

Dow:gold vs dow

Trannies:Industrials vs SPX

2s30s vs SPX

Gold/Bonds (inv.30yr yield) vs Gold

CRB:TLT vs Gold

Bonus Chart

LSG going higher.

Thursday, March 26, 2015

Chart Attack

And just like that....all re-coupled.

SPX vs. US10YT, / US30YT, HYG, USDJPY, EURJPY except our friends in Germany vs. EUR

...And Zoomed In. This is where I'll be watching for clues as well as USDJPY.

.... and possible projections if these two remain correlated.

With a look at the SPY: In order : Monthly, Weekly, 4 hour.

Tuesday, March 24, 2015

Miner Update

It's been quite the winter. Have been a bit busy and preoccupied, apologies for the lack of posts. Anywho, ever since gold put in that local top at 1300 its been a methodical and systematic take down, very technical if you've been watching/trading.

The real story still lies ahead. The rumblings continue to grow louder in various markets. The focus right now for me is on what lies ahead in the currency markets. I see gold as a currency so that fits well for me.

The miners took a nasty nose dive shortly after one of my prior missives in January when we looked at the ratios of gold:spx gold:ndx gold:spy hui:gold. We were banging up against the top rail of some down trending channels. Since then, we have reached the lower channel and now have begun to turn up. This is a great opportunity to buy the dips in the precious metals equities.

Here's one example of the charts; the rest can be recreated by typing into www.stockcharts.com "$gold:$ndx" for instance.

I like to look at these ratios to get an idea of relative strength among sectors and a sort of money flow perspective. The next chart that intrigues me the most is comparing the S+P 500

to the 20 year bonds. SPY:TLT (see below)

Since the start of 2014, bonds have been out performing the S+P500. The ratio has bounced off its 200dma 3 times now in this downward move. I suspect there is more to come. I like the long bond over the S+P and gold over them all.

...

Right when this ratio broke down, was right when the below chart lost its correlation. (SPX vs. 30YR US Treasury rate.)

The real story still lies ahead. The rumblings continue to grow louder in various markets. The focus right now for me is on what lies ahead in the currency markets. I see gold as a currency so that fits well for me.

The miners took a nasty nose dive shortly after one of my prior missives in January when we looked at the ratios of gold:spx gold:ndx gold:spy hui:gold. We were banging up against the top rail of some down trending channels. Since then, we have reached the lower channel and now have begun to turn up. This is a great opportunity to buy the dips in the precious metals equities.

Here's one example of the charts; the rest can be recreated by typing into www.stockcharts.com "$gold:$ndx" for instance.

I like to look at these ratios to get an idea of relative strength among sectors and a sort of money flow perspective. The next chart that intrigues me the most is comparing the S+P 500

to the 20 year bonds. SPY:TLT (see below)

Since the start of 2014, bonds have been out performing the S+P500. The ratio has bounced off its 200dma 3 times now in this downward move. I suspect there is more to come. I like the long bond over the S+P and gold over them all.

...

Right when this ratio broke down, was right when the below chart lost its correlation. (SPX vs. 30YR US Treasury rate.)

I think this mostly signals volatility ahead as markets begin to shift again.

As far as the miners go, they have some work to do in the charts to construct any major sea changes. Right now I continue to keep buying dips. Going into tomorrow, we are in a peculiar spot for the immediate term, action for the next intermediate move will be determined shortly. I'll touch base later this week or over the weekend with my thoughts.

Thanks for reading.

Wednesday, January 28, 2015

Miner Update

Really nothing to update here. The price action in the miners is acting very bullish. Bearish patterns have not been playing out with the same intensity from prior rallies. I believe we are going to trade higher and I think the silver miners are going to out perform. Will be monitoring that as we develop off these lows. I still won't be convinced though until gold is over 1400 steadily before I can really trust this turning into a new bull market. Until then, its just another big rally.I think gold is going to attack the 1340/50 range before we get a correction in the miners.

Subscribe to:

Posts (Atom)

%2B-%2BCopy.png)

.png)

.png)